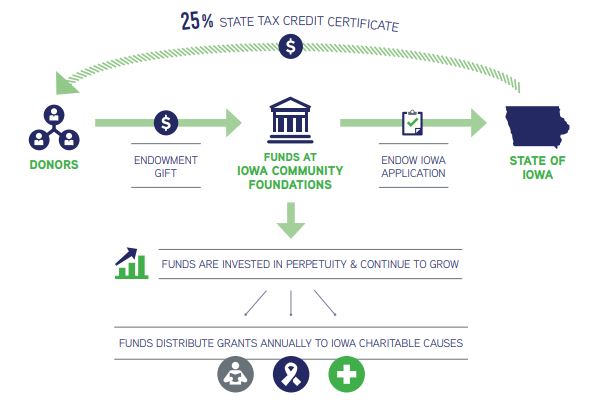

Endow Iowa Tax Credit

Giving to the causes you care about through the Community Foundation of Johnson County can come with generous tax savings, such as the Endow Iowa Tax Credit.

The Endow Iowa Tax Credit offers donors a 25% tax credit if they live in Iowa and make gifts to endowment funds held at community foundations. This program was established with the expressed purpose of incentivizing gifts to endowment funds in order to provide sustainable support to Iowa nonprofits.

Program Details:

- Tax credits are 25% of the amount gifted.

- Individuals are limited to $50,000 in tax credits per individual for a gift of $200,000 or $100,000 in tax credits per couple for a gift of $400,000 if both are Iowa taxpayers. No minimum gift amount is required to qualify for Endow Iowa Tax Credits.