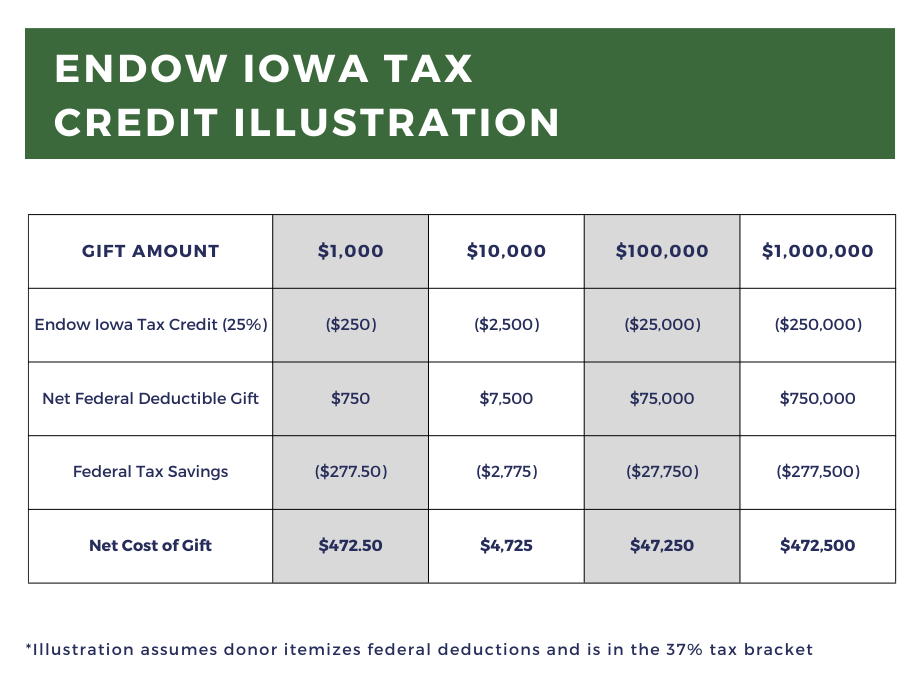

When you make a gift to an endowed fund held at the Community Foundation of Johnson, you may be eligible for the Endow Iowa 25% tax credit.

The Endow Iowa Tax Credit Program offers contributors who live in Iowa and give through the Community Foundation generous tax incentives to make it easier for you to give more for less. The program was established to encourage building permanent endowments to benefit communities across Iowa. Iowa taxpayers may apply for the tax credit if they make a gift to a permanently endowed fund that supports charitable activities in Iowa.

How It Works

- Individuals can apply for credits on up to $400,000 in gifts to the CFJC.

- Couples can apply for credits on up to $800,000 in gifts to the CFJC.

- Businesses can apply for credits on up to $400,000 in gifts to the CFJC.

- You have 12 months after making a gift to apply for the credit.

- Credits are available on a first-come, first-served basis; the allocation of credits renews in January of each year.

- If an Iowa tax credit is received for a gift, no Iowa income tax deduction for the same gift is allowed.

Because credits are available on a first-come, first-served basis, it is important to return your Endow Iowa application as quickly as possible. The Community Foundation will mail the application form to you, along with a thank you, after you make your gift. You mail the completed form back to us, and we will submit your application. Credit certificates are mailed to donors at the end of the year.